Number of EV choices jumps 66% in a year, shows new data

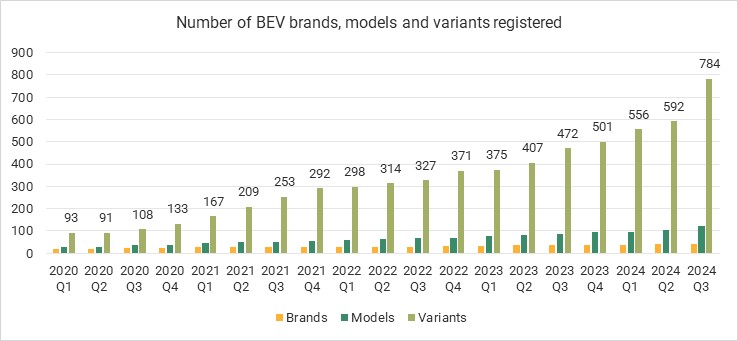

Drivers have more EV buying choices than ever before, with a 66% jump in the number of variants in the past year, according to data experts.

New car figures from automotive analysts Cap HPI show a sharp increase in the number of options throughout 2024, thanks to rapidly expanding electric line-ups from established companies and the growing number of brands offering EVs in the UK.

The number of models on offer in the third quarter of 2024 was up 39% over the previous year, with a total of 121 on sale. Taking into account different powertrain options and specification levels, Cap HPI found there were a total of 784 EV variants on sale – a 66% jump on the 472 offered in Q3 of 2023.

The data from the PowerUP report also shows an even more dramatic long-term shift. In the last four years, the number of brands selling EVs has almost doubled from 22 in the third quarter of 2020 to 43 in the same period in 2024. At the same time, the number of individual variants has rocketed 626%, from just 108 in Q3 of 2020 to 784 in 2024.

The increase is partly down to the arrival of new brands such as BYD, established brands such as Mazda launching their first EVs, and manufacturers such as Volkswagen, Kia and Polestar expanding their existing all-electric line ups.

The PowerUP report also revealed that more of the recent EV market growth has been in the smaller car segments than previously, as car makers turn their attention to the more affordable end of the spectrum.

Matt Freeman, managing consultant at cap HPI, said: “We’ve seen big shifts in the BEV market since 2020, the main reason for this being an unprecedented variety of dependable EV options, with around 132 new EV models available in the UK as of January, accounting for a third of all new cars available.

“Manufacturers have offered attractive discounts to stimulate EV sales, making them more appealing to consumers. The improving cost-effectiveness of EVs is also a major factor in increased demand, with some used models now matching or undercutting equivalent petrol models on price.”

Freeman said that the trend was set to continue throughout 2025 and have an impact on the used car market as well. He commented: “The number of manufacturers, models, and variants will continue to increase with numerous new electric vehicles slated for release in 2025. This expanding variety includes SUVs, seven-seaters, compact city cars, and offerings from manufacturers new to the electric car market.

“The UK’s ZEV mandate, which requires 28% of new car sales to be zero-emission vehicles in 2025, is driving manufacturers to expand their EV lineups. The entry of Chinese manufacturers such as BYD and Leapmotor into the UK market will likely further diversify the available models and variants.”

He added that the broader spread of models and variants, including a growing number of smaller and cheaper models such as the Renault 5 and Citroen E-C3 would lead to a more normal profile for the new and used BEV market, which was previously more heavily dominated by larger, more expensive SUV models.